| Smart Tips For Cracking NDA Examination |

| Knowledge Of Complete Syllabus in Details Of The Exam. |

| Continuous Practice Till Your NDA Exam gets cracked. |

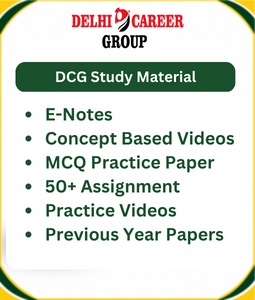

| Availability Of Best & Useful Study Material. |

| A Solid Revision Time Table Pattern. |

| Time To Time Preparation of Progress Report. |

| Try Hard Reforms To Improve Weakest Areas. |

| Don’t Waste Your Time In Solving That Questions Seeming Easy To You. |

| Always keep In Mind Of The Negative Marking As It Can Be A Failure Point For You. |

| Take The Time Management Into Your Consideration As it is most important aspect Of Exam. |

| At last doesn’t be afraid of Exam “Be patient while you prepare”. |

IPCC – Integrated Professional Competence Course

Integrated Professional Competence Course is the identification for the second level of the CA (Chartered Accountancy) course conducted by the ICAI (Institute of Chartered Accountants of India). After getting through the CA CPT (Chartered Accountancy Common Proficiency Test), students can appear for this course. The examination at the end of the course is identified as IPCE (Integrated Professional Competence Examination).

IPCC includes the core and allied subject related to the profession of Accountancy. The course is divided into 2 groups containing total seven subjects. The first group has 4 subjects and the second group has 3.

Group II

PAPER I: Accounting

It cover General knowledge of the framing of the accounting standards, national and international accounting authorities, adoption of international financial reporting standards, Accounting Standards-1, 2, 3, 6, 7, 9, 10, 13 and 14, company accounts, Self-balancing ledgers, Financial Statements of Not-for-profit-organization, Accounts from incomplete records, Accounting for special transactions, issue in partnership accounts and accounting in computerized environment.

This paper has been divided in three parts:

Law – Covers the practical application of business law including Indian Contract act, Negotiable instrument act, Payment of bonus act etc. and provisions of company law covering The Companies Act from section 1 to 197

Ethics – Provides understanding of ethical issues in business including environmental issues, ethics in workplace, Marketing & Consumer protection and Accounting & Finance.

Communication – Covers development of behavioural skills and communication relating to business covering elements like Communication, Communication in Business environment and basic understanding of legal deeds and documents.

PAPER IV: Taxation This paper has been divided in two parts:

Income Tax –Covers the income under five heads namely salaries, house property, capital gains, profit and gain from business and profession and other sources.

Service Tax and VAT –Cover the provisions of service tax like payment of service tax and filling of returns and concepts of Value Added Tax.

PAPER V: Advanced Accounting –It cover Conceptual framework for preparation & presentation of financial statements, Application of accounting standards 4,5,11,12,16,19,20,26 and 29, Cases relating to company accounts, advanced issues in partnership accounts and accounting for special transactions.

PAPER VI: Auditing and Assurance –It cover Generally Accepted Auditing Procedures, techniques and skills like verification and vouching of assets & liabilities, company audit, auditing standards needed to understand the objective and concepts of auditing and to apply them in audit and attestation processes.

This paper has been divided into two parts:

Information Technology –Covers an introduction to computers, Data base management systems, computer networks and network security, internet & other technologies and decision tree flow charts.

strategic management –Covers business environment and strategies of business like Strategic Analyses, Strategic Planning, Implementation & control etc.

Statutory audit, Internal audit, Compulsory tax audit, Certification and audit.