CA CPT Examination is the entrance to the Chartered Accountant, which is turned into the fascination for the youngsters. In CA, profession turns into a reason for intelligent and sharp minded quality. There are various obstacles additionally you have an opportunity to enhance your abilities. CA is designation typically proves the holder has the qualifications to audit financial statements and commercial enterprise practices in addition to provide advisory services to clients. The examination held two times in one year.

After the Secondary education students have more options for Career. Common Proficiency test is entry level test for CA course. learn some short cut methods, Keep practicing daily, practice previous year’s question papers, You should read each and every topic in detailed, work hard on the various weak points

Delhi Career Group is an Institute for the preparation for the CA CPT Exam. Delhi Career Group plays an important role in the form of training students for the competitive exam with good quality teaching and study materials and enabling them to crack the exam in stipulated time period and low cash. Best CA CPT Coaching Institute In Chandigarh is Delhi Career Group provide the best study material for CA CPT exam from various coaching Institute. The study material of the Topmost coaching Institute helps the candidate to crack the exam easily.

Delhi Career Group is the best Preparation Coaching Institute in Chandigarh which aim to provide highly education, competitive and friendly atmosphere. Best institute in Chandigarh for CA CPT Exam is Delhi Career Group provided a healthy environment for growth learning. The candidate is given mock test series for preparation of exam. We focus on developing the strong base of the candidate in theoretical as well as practical knowledge exam. Our unique methodologies raise the candidate, confidence level and also make them able to crack the CA CPT Exam.

| Why Delhi Career Group Institute for Best CA CPT Exam Coaching |

| 60 Days To 3 Months CPT Coaching Classes. |

| 3 To 4 Hours Daily Regular Classes & Daily Speed Test. |

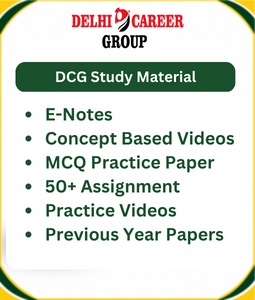

| Study Material And Test Series Are Designed On The Latest Pattern |

| Intensive Practice Sessions By Experts On Mock CA, CPT Exam Preparations. |

| Use Of Short Cut Techniques For Mathematics, Accounting, Laws. |

| Highly Experienced Teachers For Each Subject. |

| 6 Booklet Sets With Over 2000 Questions for Providing Best CPT Coaching Classes. |

| Classes Seven Days A Week (Sunday Also). |

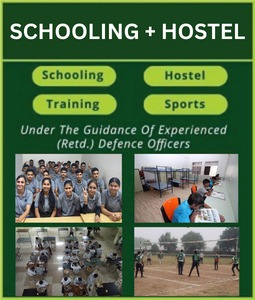

| Hostel / PG Facilities For Students From Outside (Other State). |

| Regular & Weekend Batches Available. |

| Online & Offline Mock Test For Registered Students. |

Best CA CPT Coaching Insitute in Chandigarh

Common Proficiency Test (CPT) is a centralized eligibility test to do CA course, which is conducted by Institute of Chartered Accountants of India (ICAI). The test is taken after 10+2 for admission into Chartered Accountancy course.

CA CPT 2020 Important Dates

The candidates can check important dates in the table below. We will update the actual date after the release of official notification. Candidates can prepare as per the following schedule:

| Event | Date |

| CA CPT June 2020 Notification | 05 February 2020 |

| Last date for registration | 26 February 2020 |

| Last date of filling CPT application form 2020 and making the payment (with late fee) | 04 March 2020 |

| Application Correction Window I (without late fee) | May 2020 |

| Application Correction Window II (with fee) | May 2020 |

| CA CPT Exam date | J11th, 13th, 15th & 17th May 2020 |

| Result declaration | July 2020 |

CA CPT Application Fee 2020

| Category | CA Foundation Application fee mentioned below is as per year 2019. |

| For exam centers in India only | Rs.1500/- |

| For exam centers in Kathmandu (Nepal) | Rs.2200/- |

For CA CPT Online Form Follow Given Procedure:

The registration forms will we available by the institute’s website. For online registration of CA CPT Exam you must fill the following given field: Full Name (Capitals letter)

For online registration of CA CPT Exam, you can pay the fee through ICICI bank. Attached all the documents and print out the registration and send it to the ICAI (Institute of Chartered Accountant of India).

Documents that are enclosed along with CA CPT Registration Application:

Syllabus and Pattern of 2020 CA CPT Exam

| SUBJECT | Marks |

| Fundamentals Accounting. | 60 – Marks |

| Mercantile Law. | 40 – Marks |

| General Economics. | 50 – Marks |

| Quantitative Aptitude. | 50 – Marks |

| Total | 200 – Marks |

The CA CPT Test Is Divided In To 2 Sessions

Combined Graduate Level (Tier-Ii) Examination:

Students can register for the Common Proficiency Course (CPC) after passing 10th examination and can appear in the CPT either on appearing or passing 10+2 examination. Validity for CPT registration is 3 years, thereafter revalidation is made after every 3 years. Join us for Best Coaching Centre Institutes for CPT Exam in Chandigarh.

Passing Criteria for CA CPT Exam:

To pass/qualify CA CPT Exam a candidate must obtain minimum 30% in each subject and 50% overall. Candidates who ranked among top 10 will get scholarship.

Fundamentals of Accounting Syllabus for CA CPT Exam:

Theoretical Framework

Accounting Process

Books of Accounts leading to the preparation of Trial Balance, Capital and revenue expenditures, Capital and revenue receipts, Contingent assets and contingent liabilities, Fundamental errors, including rectifications thereof.

Bank Reconciliation Statement

Inventories

Basis of inventory valuation and record keeping.

Depreciation accounting

Methods, computation and accounting treatment of depreciation, Change in depreciation methods.

Preparation of Final Accounts for Sole Proprietors

Accounting for Special Transactions

Final accounts of partnership firms – Basic concepts of admission, retirement and death of a partner including treatment of goodwill.

Introduction to Company Accounts

Issue of shares and debentures, forfeiture of shares, re-issue of forfeited shares, the redemption of preference shares.

Mercantile Laws Syllabus:

This section carries total 40 marks and objective of this section is to test the general comprehension of elements of mercantile laws.

The Indian Contract Act, 1872:

An overview of Sections 1 to 75 covering the general nature of contract, consideration, other essential elements of a valid contract, performance of contract and breach of contract.

The Sale of Goods Act, 1930:

Formation of the contract of sale – Conditions and Warranties – Transfer of ownership and delivery of goods – Unpaid seller and his rights.

The Indian Partnership Act, 1932:

General Nature of Partnership – Rights and duties of partners – Registration and dissolution of a firm.

General Economics Syllabus:

This section carries total 50 marks and objective of this section is to ensure basic understanding of economic systems, economic behavior of individuals and organizations.

Micro Economics

Introduction to Micro Economics

Theory of Demand and Supply

Theory of Production and Cost

Price Determination in Different Markets

Indian Economic Development

Indian Economy – A Profile

Select Aspects of Indian Economy

Economic Reforms in India

Money and Banking

Address: SCO-215-216-217, Above Near ICICI Bank,First Floor,Backside Entry, Sector 34/A, Chandigarh, 160022

Phone: 08427339559